360. Potential farmer responses to extreme prices for nitrogen fertiliser

For various reasons, the current price of nitrogen fertiliser is sky high. How should farmers respond?

Crop farmers in Australia are currently ordering the inputs needed for sowing their crops in about April next year. They are particularly grappling with how much nitrogen (N) fertilizer to order, given that it currently costs two to three times as much as it cost them for the 2021 season.

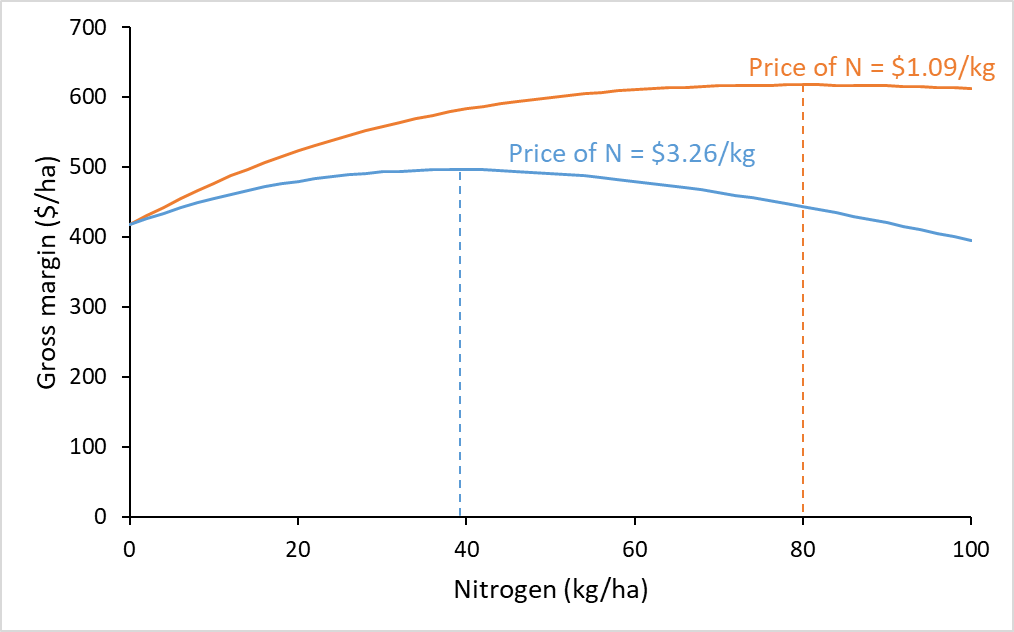

One obviously sensible option is to reduce the rates of N fertiliser that are applied to crops. Figure 1 shows how N fertiliser price affects the relationship between N rate and profit for a particular example in Western Australia (a wheat crop with farm-gate grain price $300; yield potential 2.5 tonnes/ha, no change in grain price for higher grain protein). It shows that the optimal N rate with a urea price of $500/tonne is around 80 kg/ha (that’s the N rate corresponding to the highest point on the profit curve). But if the price is $1500/tonne, the optimal N rate falls to about 40 kg/ha. Tripling the price halves the optimal rate (in this example).

The graph also shows that if the farmer continued to apply 80 kg/ha of N despite a much higher N price, they would make less profit than they could make if they reduced the N rate to 40. In other words, the reduction in profit as a result of the higher N prices will be less if N rates are cut.

Protein

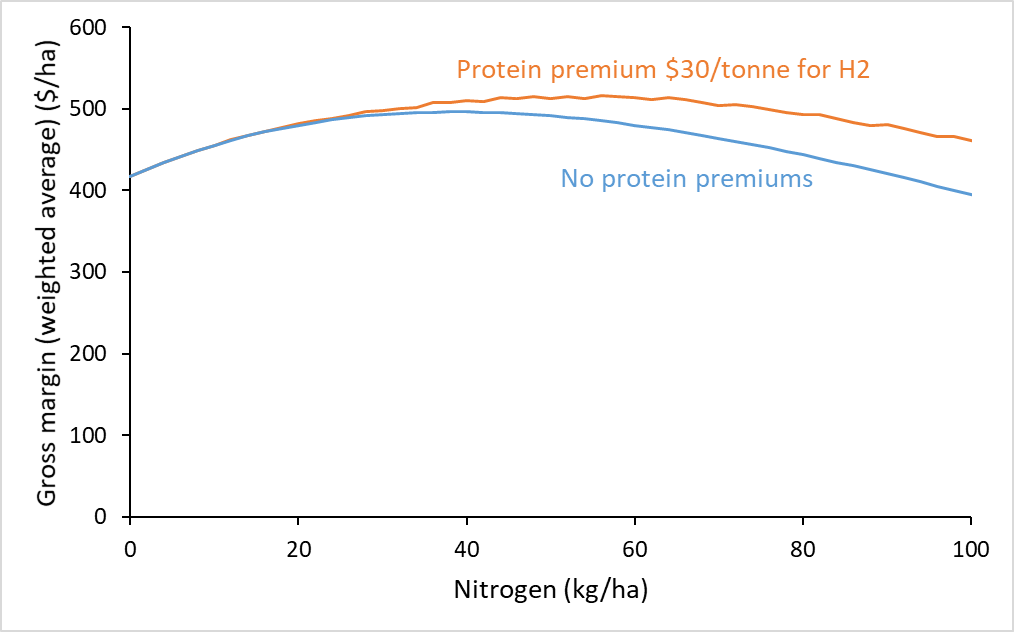

For wheat, in particular, the price premiums received for high-protein grain can be an important consideration when choosing N rates. This is because applying more N tends to increase grain protein (as well as yield). But when N prices are high, do protein premiums provide enough incentive to push up the optimal N rate?

Figure 2 shows results when my example is expanded to include protein premiums. I’m assuming that with no N application there would be 9% protein in the grain, and that it takes 35 kg N/ha to increase the protein by 1%. I’m using the following protein premiums above ASW quality grain: $10 for APW2; $20 for APW1 and $30/tonne H2. The graph shows the weighted average result for a wide range of potential yields, allowing for the fact that protein gets diluted when the yield is higher.

As you’d expect, protein premiums push up profits at higher N rates. For this particular example, this increases the optimal N rate from about 40 to about 60 kg/ha. However, the economic benefit from increasing the N rate in that way is very small. Looking along the orange line, the difference in expected profit between 40 and 60 kg N is only $4/ha. In this example, even with very high N prices, chasing protein to a small extent is not a bad thing to do, but it’s not a particularly good thing to do either: the benefit from doing so, on average, is very small.

(I’ve often talked about how flat these payoff curves generally are near the optimal rate. See PD88. It means that, although a sizable rate cut makes sense, getting the size of that rate cut exactly right is not important.)

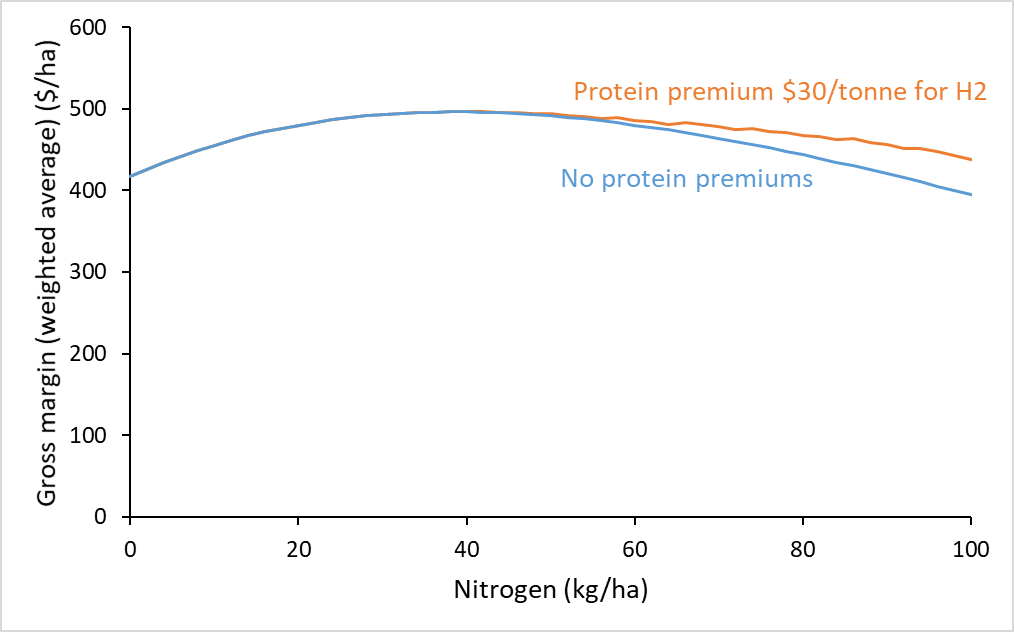

This specific result depends on a range of things, including the general protein level of the crop. Figure 3 shows the results if 30 kg/ha of N (rather than zero in Figure 2) results in 9% protein. There is no increase in the optimal N rate (in this example). The flat part of the gross margin curve just gets a bit wider. In this case, as a best-bet recommendation, there is no compelling reason to chase protein.

Of course, if it turns out to be a great growing season, or grain prices are high, or protein premiums are especially high (as they happen to be right now in December 2021), higher N rates look great. But going down that line when N prices are high is not a best-bet decision. It’s just a bet.

What if N prices fall later?

What if N prices fall next year, in time to order additional N for later applications? Suppose this happens too late to increase the N rate at seeding, but cheaper N is available for topping up N during the season. I was asked about this last week in a meeting with agricultural consultants – specifically, what price should farmers use when thinking about how much N to top up? Should they use the new low N price, or perhaps an average of the high and low prices?

The answer is that if new N is being purchased at a lower price for post-seeding applications, only that low price matters when thinking about rates for that post-seeding application. The fact that the first application of N was really expensive is irrelevant.

This means that if prices do fall, farmers may end up applying roughly normal N totals for the season as a whole. In this light, their current decision is just about how much expensive N to apply at seeding. Choosing now to buy enough fertiliser for low N rates at seeding doesn’t rule out applying more N later if N prices drop.

Other strategies

Another potential response to high N prices is to switch away from crops that typically have high rates of N applied to them. The options could perhaps include growing a larger than usual area of legume crops that fix their own nitrogen (e.g., lupins, field peas, chickpeas), switching from crop production to pasture/livestock production, or having a fallow year. These strategies will make more or less sense on different parts of a farm.

The economics of switching land use like this is very case-specific, depending on factors such as soil type, farm infrastructure, labour availability, the yields and prices of the relevant products, and the farmer’s skills and preferences.

Overall, the best strategy in response to extremely high N prices could involve a combination of reducing N fertiliser rates on some parts of the farm and switching land use on others.

Further reading

Pannell, D.J. (2006). Flat-earth economics: The far-reaching consequences of flat payoff functions in economic decision making, Review of Agricultural Economics 28(4), 553-566. Journal web page ♦ IDEAS page

Pannell, D.J. (2017). Economic perspectives on nitrogen in farming systems: managing trade-offs between production, risk and the environment, Soil Research 55, 473-478. Journal web page

It would be interesting to look at the interaction between nitrogen use efficiency and nitrogen price.

Hi Dave,

Are these graphs from your 2017 paper in Soil Research, or created from a model?

Similar spreadsheet model as used in that paper, but these are fresh graphs.

This is very timely analysis Dave. Depending on the region, a larger proprtion of the N is applied post-seeding. How long can a WA grower delay purchasing their N fertiliser?

If I was a farmer in the east of Australia where there has been record spring rainfall, and I had seed, immediately after harvest I would spray out the weeds and volunteers and direct seed a green manure legume into the cereal stubbles, for killing off in autumn ahead of planting a winter crop. The soil profile is full, the long range rain forecast is positive, worth a chance with prospects of at least 100 kg N fixed? But what to plant and is there seed?