412. Risk aversion and fertiliser decisions

This Pannell Discussions is about risk aversion and its influence on strategic decisions about the optimal rate of a fertiliser to apply, particularly nitrogen fertiliser.

Over the years this has been a topic of some confusion and misinformation. The key question is whether nitrogen fertiliser is a risk-decreasing input (higher rates have lower risk) or a risk-increasing input (higher rates have higher risk). If it’s a risk-decreasing input, then farmers who are more risk-averse would tend to put on more fertiliser. But if it’s a risk-increasing input, risk aversion would encourage lower fertiliser rates.

In Australia, a common assumption amongst scientists who work on fertilisers is that grain farmers consider fertilisers to be risk-increasing, and hence they don’t apply enough fertiliser to maximise expected profits.

Interestingly, in North America, the usual assumption is exactly the opposite. People assume that farmers perceive fertilisers to be risk-reducing – and that is seen as one of the reasons many farmers apply too much fertiliser. It’s true that many farmers in those regions do apply excessive fertiliser, causing lost profits, water pollution and unnecessary greenhouse gas emissions. But how much of that is due to risk aversion?

I’d observe that most of the commentary about the effect of risk aversion on fertiliser use is conducted in an evidence-free zone. It is largely based on assertions and assumptions. Two types of evidence are relevant to the discussion: (a) what do farmers themselves perceive regarding whether fertilisers are risk increasing or risk decreasing, and (b) what does the biological and economic evidence say?

There is a small amount of evidence about farmers’ perceptions. For example, a few surveys in the US have found that various farmers do see fertiliser as risk-reducing, while one recent survey in Western Australia indicates that risk aversion has almost no impact on fertiliser decisions of grain growers (Petersen et al. 2023).

On the other hand, there is a lot of empirical evidence about the actual effect of nitrogen fertiliser rates on the riskiness of agricultural production. Examples of studies that have looked at this include Just and Pope (1979) (using experimental data for corn and oats in Mississippi), Nelson and Preckel (1989) (using farm data for corn in Iowa), Love and Buccola (1991) (using farm data for corn in Iowa), Roosen and Hennessy (2003) (using experimental data for corn in Iowa), Rajsic et al. (2009) (using experimental data for corn in Ontario, Canada), Monjardino et al. (2015) (using a crop simulation model for wheat in southern Australia), Gandorfer et al. (2011) (using experimental data for various crops in Germany), Meyer-Aurich and Karatley (2019) (using experimental data for wheat in Germany), Schaub and El Benni (2023) (using experimental data for pasture and wheat in Switzerland), and Chai et al. (2023) (using experimental data for corn in various US states).

In every case, the empirical results indicate that fertiliser is a risk-increasing input.

In addition to these studies, which focus primarily on production risk, we know that price risk acts to further increase overall risk at higher input rates, assuming that additional fertiliser increases expected yield (Sandmo, 1971). In other words, price risk also contributes to nitrogen fertilizer being a risk-increasing input.

As far as I am aware, there is absolutely no empirical evidence that fertiliser is a risk-reducing input, in any country, for any type of crop. That raises interesting questions about why some American farmers think it is one.

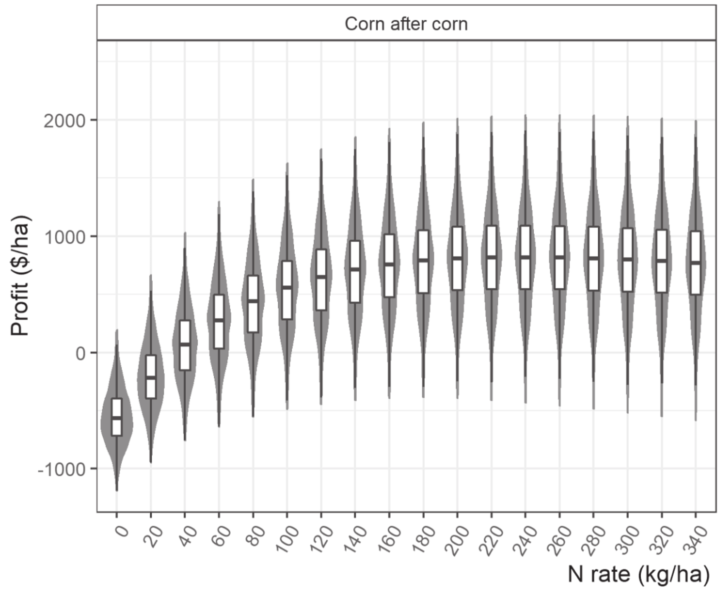

On the other hand, the degree to which risk increases as the fertiliser rate increases is generally very low. It’s so low that my view is that risk aversion should usually be an irrelevant consideration when choosing fertiliser rates. In Chai et al. (2023), we found that realistic levels of risk aversion changed the optimal fertiliser rate by less than 1 kg/ha — much too little to matter. You can see why in Figure 1.

The black horizontal lines near the middle of the white rectangles at each nitrogen rate show the median value of profit. The vertical lines and the bulges around them show the range and distribution of profit levels for each nitrogen rate. Around the profit-maximising nitrogen rate (about 220 kg/ha), varying the nitrogen rate makes almost no difference to the risk. Higher rates are riskier (there is a wider distribution) but only very slightly, so risk aversion would not be a strong driver of the decision about nitrogen rates.

Note that the issue is not whether there is risk at a particular fertiliser rate. There is significant risk at every fertiliser rate, as indicated by the bars and bulges above and below the median line. Instead, the issue is whether a farmer can avoid some of that risk by changing to a different rate. Given that risk is very similar at all rates within the vicinity of the optimum, there is no escaping from that risk. That means that even highly risk-averse farmers have little to gain by adjusting their fertiliser rates in an attempt to avoid risk.

The results in Figure 1 are for corn in the US, but I’m confident that the situation for the main grain crops in Australia is broadly similar.

Further reading

Chai, Y., Pannell, D.J. and Pardey, P. (2023). Nudging farmers to reduce water pollution from nitrogen fertilizer, Food Policy 120, 102525. Full paper

Petersen, E.H., Hoyle, F.C., Scanlan, C.A., Burton, M.P., Oliver, Y.M. and Murphy, D.V. (2023). Agronomic factors are the dominant inluence on nitrogen fertilizer strategies in dryland cropping systems, Agronomy for Sustainable Development 43, 14. Full paper

This is #6 in my RiskWi$e series. Read about RiskWi$e here or here.

The RiskWi$e series:

405. Risk in Australian grain farming

406. Risk means probability distributions

408. Farmers’ risk perceptions

409. Farmers’ risk preferences

410. Strategic decisions, tactical decisions and risk

412. Risk aversion and fertiliser decisions (this post)

413. Diversification to reduce risk

414. Intuitive versus analytical thinking about risk

415. Learning about the riskiness of a new farming practice

416. Neglecting the risks of a project

418. Hedging to reduce crop price risk

419. Risk premium

420. Systematic decision making under risk

421. Risk versus uncertainty

422. Risky farm decision making as a social process

423. Risk aversion versus loss aversion, part 1

424. Risk aversion versus loss aversion, part 2

433. Depicting risk in graphs for farmers

Very nice!! I wonder to what extent an enforced reduction in fertiliser use by 30% would have on yields and risk. After all, despite some politicians comments to the contrary, Canadian and European climate policy is to mandate a reduction in fertiliser use by 30-33 % .

Hi Kees, The flatness of the profit function means that the effect of a 30-33% reduction on profit would be pretty small in most cases. Check out the Chai et al. paper given at the end of this post.

Nice. In theoretical terms, Bob Chambers and I have argued that it’s neater to think of inputs as risk complements/substitutes (more/less used when producers choose a riskier production plan) than risk-increasing or risk-reducing. But I agree that it’s hard to see how fertiliser can be other than risk-increasing/complementary

Thanks John. Yes, I understand, though I think it’s probably easier to explain to most people in terms of “risk increasing”.

David, I’d suggest that in-crop nitrogen applications in Australia are a very different scenario to say phosphorus applications pre-crop. And different crops do have very different yield responses to each nutrient. There is a lot in what you are exploring here, specifics about timing, nutrient and crop will be enlightening.

I totally agree. In-crop application gives an opportunity for tactical adjustments in rates that can increase profit and reduce risk.

Informative article, thanks David. This is an important topic, and not just for farmers. It is disturbing that ‘most of the commentary . . . is in an evidence-free zone’ – a nice phrase for a common situation. As an ex-water-pollution sampler, I can add that nitrogen sprinkled on the land can lead to much of it being washed off into the waterways, causing (1) excessive algal growth and de-oxygenation (called eutrophication), and (2) to faster oxidation of humus holding the soil together, causing soil erosion and lower availability of soil micro-nutrients released by the fungal content of humus. As an amateur gardener, I have seen for myself how build-up of organic matter in soil can cheaply transform plants from weak yellow to robust green in a season or two. I seriously wonder why (1) and (2) are not part of the cost equation for farmers and the advising scientists considering the fertility and security of productive soils.

Yes, the evidence shows that the more N is applied, the larger the proportion of it that is lost in run off or to groundwater.

Hi David and John, I would also add that increasing N rates also increases the risk of soil N2O emissions (and in a non-linear fashion).

David, most of your cited references are from places other than Australia. What is the impact on risk aversion and the perception of the riskiness of fertilizer as a consequence of Australian farmers operating in a free market as opposed to their European or American counterparts who are subsidised (heavily in some instances) ? I would suggest that it may well be drawing a long bow to use the attitudes to risk of US or European farmers to infer those of Australian farmers, especially given the differences in climate variability that can be experienced by these different cohorts. and which, arguably, are one of the drivers of Australian riskiness. Or maybe it isn’t, but it would be good to know ?

Thanks Rob

This post is less about risk aversion and more about the fact that changing fertiliser level makes almost no difference to the riskiness of crop production. So that takes risk aversion out of the equation really.

But since you comment on risk aversion in the three places (Australia, the US and Europe), there is empirical evidence about risk aversion in all three, and it’s reasonably consistent. Most farmers are risk averse, but not very, unless they are small farmers.

A farmer chat about fert https://youtu.be/i4p3EndYeCI?si=Wt9LT_u7RhaOmq1T&t=389