420. Systematic decision making under risk

Intuitive decision making can be good, but as we’ve seen in earlier posts in this series, sometimes it can lead us astray. When faced with risk, how can we approach decision making in a more systematic way to reduce the chance of us falling prey to our own biases and misjudgments?

There is a well-accepted method for doing this, called Decision Analysis. This was developed around the middle of the 20th century and has been explained in dozens of books and used for countless different types of decision problems. In the context of agriculture, the most famous of the books is the appropriately named Agricultural Decision Analysis, by three Australians: Jock Anderson, John Dillon and Brian Hardaker from the University of New England. This was published in 1977, when UNE was rightly seen as a world leader on this topic. When I was learning about risk and Decision Analysis in the early 1980s, I read several texts, but theirs is the one from which I learned the most. Their follow-up book, Coping With Risk in Agriculture (Hardaker et al. 2015), is also great and is a bit easier to follow.

Since 1977, a lot has changed in agriculture, but the logic of Decision Analysis still stands up. Based on Decision Analysis, I’m going to briefly describe how to make risky decisions in a logical, systematic way.

Many web pages list a series of steps to use for decision making. I’m basing my post on a list provided by https://www.techtarget.com/searchbusinessanalytics/definition/decision-making-process because it lines up well with Decision Analysis.

1. Specify the decision problem

What is the decision to be made? For example, Dave the risk-averse farmer is making a decision about whether to buy a 1,000-hectare block of land.

2. Specify the objective

What outcome variable do you want to use to evaluate the decision options? If Dave wasn’t risk-averse, it might be expected profit, but for him it is expected profit minus a risk premium (see PD419).

3. Identify the decision options

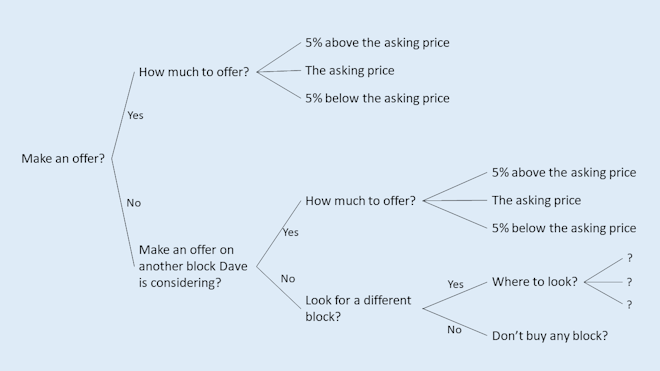

What are the potential decisions that could be made? The obvious decision options for Dave are to offer to buy the block, or not to make an offer. However, it’s not actually that simple. A decision to make an offer has to include a sub-decision of how much to offer. Obviously, there are many options there.

If the decision is not to make an offer, there are various options as well. Dave has also been thinking about another block; maybe he makes an offer on that instead (and if so, how much for?). Or should he keep looking around for something better? If so, in what areas should he look? Or should he not buy any block?

A tool that can be very helpful at this stage is to develop a decision tree showing which decisions depend on other decisions. This can help you get your thinking straight and help avoid thinking too narrowly about the options. Dave gets out a large sheet of paper, and after a few attempts, comes up with the following.

This makes it clear that the initial decision – whether to make an offer on a certain block of land – depends on everything else in the right half of the diagram. Being clear about that, and thinking through the other decisions, helps Dave make the initial decision.

Implicit in this is that the decision options have to be feasible. If they require more labour or more finance than is available, they are not really decision options, just ideas.

4. Gather information

Collect relevant information to evaluate the decision options. For Dave, this includes recent land sale prices in the district and in other districts, recent crop yields on the block, and the interest rate on the loan he’ll need to take out.

5. Evaluate decision options

Assess each alternative against the selected objective. Do some calculations for each of the decision options to see how they could perform. Dave is not an economist or a financial analyst, so he’s not going to do 1000 random simulations of each decision option and calculate expected utility, but he’s got a fairly simple strategy that is quite informative.

For the key variables that Dave is unsure about, he selects and writes down a favourable value (for if things go better than expected), an unfavourable value (worse than expected) and an expected value (best bet).

He then does his calculations for a number of scenarios: (a) everything goes as expected, (b) everything is worse than expected, (c) everything is better than expected, and maybe (d) two or four scenarios that are a mix of good and bad numbers. From this, for each decision option, he comes up with three, five or seven profit outcomes that might occur. The first one is the most likely, the second and third are unlikely but possible, and the others are within the range of reasonably likely outcomes.

As well as indicating the potential profit outcomes, he can see the range of profit outcomes for each decision option, giving him a sense of their relative riskiness.

This strategy owes a lot to the ideas presented by Bill Malcolm in his 2004 paper on farm-management decision making, but it’s also essentially a simplified version of Decision Analysis.

6. Make the decision

Choose the alternative that best aligns with the chosen objective. Dave looks at the profit results for the three, five or seven scenarios he’s calculated and makes an all-thing-considered judgment about what decision to make. He doesn’t explicitly calculate a risk premium to reflect his risk aversion but he looks at the riskiness of the outcomes from the different decision options and he considers this subjectively.

7. Implement and monitor

Implement the decision and see how it goes. Buying land cannot easily be reversed or modified, but many annual management decisions can be changed in subsequent years if they aren’t working out. For these decisions, monitoring their performance feeds directly into subsequent decisions.

Decision Analysis can be done in a highly complex, sophisticated way, involving extensive and detailed computer modelling. But hopefully I’ve conveyed a sense that a simplified approach that is consistent with the thinking behind Decision Analysis can still be valuable. For small, simple decisions, it’s probably not worth going to even this bother, but for larger or more complex ones, it could well be worth it.

Further reading

Anderson, J.R., Dillon, J.L. and Hardaker, J.B. (1977). Agricultural Decision Analysis, Iowa State University Press. Full book here

Hardaker, J.B., Lien, G., Anderson, J.R. and Huirne, R.B.M. (2015), Coping with Risk in Agriculture: Applied Decision Analysis, 3rd Edn, CABI Publishing, Wallingford. Full book here

Malcolm, L.R. (2004). Farm Management analysis: a core discipline, simple sums, sophisticated thinking, AFBM Journal 1(1), 45-56. Full paper here

This is #13 in my RiskWi$e series. Read about RiskWi$e here or here.

The RiskWi$e series:

405. Risk in Australian grain farming

406. Risk means probability distributions

408. Farmers’ risk perceptions

409. Farmers’ risk preferences

410. Strategic decisions, tactical decisions and risk

412. Risk aversion and fertiliser decisions

413. Diversification to reduce risk

414. Intuitive versus analytical thinking about risk

415. Learning about the riskiness of a new farming practice

416. Neglecting the risks of a project

418. Hedging to reduce crop price risk

419. Risk premium

420. Systematic decision making under risk (this post)

421. Risk versus uncertainty

422. Risky farm decision making as a social process

423. Risk aversion versus loss aversion, part 1

424. Risk aversion versus loss aversion, part 2

433. Depicting risk in graphs for farmers