418. Hedging to reduce crop price risk

Grain farmers in Australia (and most other places) make relatively little use of market mechanisms to reduce (“hedge”) price risk. Why is that?

Two methods for hedging grain price risk are forward contracts and futures contracts. (I’ll skip a third method, options.) These methods reduce price risk for the contracted amount of grain, but this benefit comes with some costs attached, as we’ll see. The essence of both methods is that they involve a buyer and a seller committing to trade grain for a particular price in future.

The two approaches have in common that the buyer is absorbing the seller’s price risk, and the buyer will need some incentive to be willing to do that. In general, the purchase price that buyers are willing to commit to will be less than what they expect the price to be at the time of the trade (i.e., less than the mean of their probability distribution for the grain price).

That’s the first thing that tends to turn some farmers off hedging. Although hedging results in more stable profits, on average, in the long run, it also results in farm profits being lower than they would have been without hedging.

The fact of expected profits being lower doesn’t necessarily mean that hedging is a bad idea. If the farmer is sufficiently risk-averse, it could be worth putting up with lower expected profits in order to reduce price risk. It’s a bit like insurance. Insurance costs more than the expected payout of claims, but we often judge that the extra cost is worth bearing to reduce risks we face.

A second thing that forward contracts and futures contracts have in common is transaction costs. This includes any legal costs, the costs of getting expert advice, the cost of the farmer’s time to understand and undertake the process, and the cost of meeting margin calls for futures. (A margin is money that has to be lodged with the brokerage firm that is managing the process, to ensure that the traders stick with the deal if the market price shifts in a way that would tempt them to renege.) Transaction costs further reduce the benefit to a farmer from hedging.

Thirdly, the attractiveness of hedging is affected by the level of production risk. Once a farmer has committed to selling a certain amount of grain at a certain price, what happens if their production year is so bad that they don’t have that amount of grain available to sell? They still are on the hook to provide that amount, so they have to do some buying of grain (or of futures contracts) to be able to meet their commitment. In general, the higher the level of production risk, the less attractive hedging is.

Fourthly, the benefits of hedging depend on how risk-averse the farmer is. As I’ve noted in earlier posts, most commercial farmers in developed countries are risk-averse, but not highly risk-averse, so it’s an open question whether the benefits to them from hedging will be sufficient to outweigh the costs.

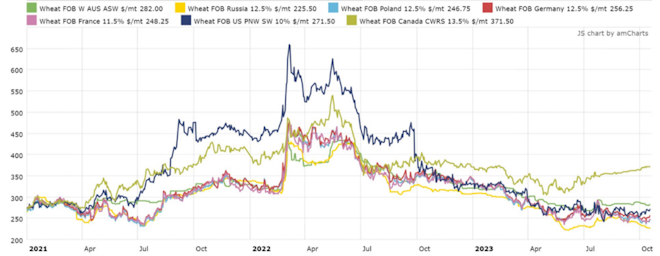

A fifth cost that mainly applies to futures is basis risk. This is about whether the product specified in the contract is the same as the product that the farmer will grow. A wheat futures contract is for a specific type of wheat, and the wheat futures markets are located in the USA, not Australia; Chicago wheat futures contracts are for soft red winter wheat while the Kansas exchange offers futures for hard red winter wheat. But Australian wheat farmers don’t produce either of those wheat types. While the prices of the wheats that Australian farmers produce are correlated with the prices of red winter wheat in America, the correlation is far from perfect. (You can get a sense of that from the graph above, showing wheat prices in different places.) The lower the correlation (the higher the basis risk), the less useful a futures contract is for hedging, because it does a poorer job of cancelling out price risk.

A final point that isn’t often talked about is that a farmer may have different price expectations than the market. We saw in PD408 that farmers can vary widely in their guesstimates of what prices will do. If a farmer has optimistic price expectations relative to the market, the incentive to use forward contracts or futures can be greatly reduced. Why would they lock in at a price that is lower than they expect the price to be on the spot market when they’ve got grain to sell? On the other hand, if a farmer has pessimistic price expectations relative to the market, the incentive to use forward contracts or futures is increased, but in that situation, the main motivation is speculation rather than hedging. By that, I mean that the main reason to enter a contract would be to increase expected profits rather than to reduce risk.

Overall, it’s not surprising that many Australian farmers don’t hedge their grain prices. It’s complex, and there is probably not all that much to be gained (on average) because of the costs involved and the fact that most farmers are not highly risk-averse. There are probably other ways to reduce their overall risk that are easier to understand and less costly (e.g. PD413).

Further reading

Pannell, D.J., Hailu, G. Weersink, A., and Burt, A. (2008). More reasons why farmers have so little interest in futures markets, Agricultural Economics 39(1), 41-50. Full paper

This is #11 in my RiskWi$e series. Read about RiskWi$e here or here.

The RiskWi$e series:

405. Risk in Australian grain farming

406. Risk means probability distributions

408. Farmers’ risk perceptions

409. Farmers’ risk preferences

410. Strategic decisions, tactical decisions and risk

412. Risk aversion and fertiliser decisions

413. Diversification to reduce risk

414. Intuitive versus analytical thinking about risk

415. Learning about the riskiness of a new farming practice

416. Neglecting the risks of a project

418. Hedging to reduce crop price risk (this post)

419. Risk premium

420. Systematic decision making under risk

421. Risk versus uncertainty

422. Risky farm decision making as a social process

423. Risk aversion versus loss aversion, part 1

424. Risk aversion versus loss aversion, part 2

433. Depicting risk in graphs for farmers

Beautiful, succinct summaries, thank you David. I’ve always been hazy about futures. I toyed with them once when a research grant payment 3 years after the costed proposal turned out to be insufficient because of cost inflation. However, like the farmers, I did not have time to fully understand the whole process and felt there were too many risks that way too.